Indiana House approves $1 billion tax cut for businesses, Hoosiers

The Indiana House approved a tax cut package Thursday that will eventually cost the state $1 billion a year in revenue.

The bill, HB 1002, includes a mixture of business, utility and individual income tax cuts. The income tax cut would eventually save a Hoosier household making $56,000 a year about $128 in taxes.

House Speaker Todd Huston (R-Fishers) said even that amount can make a difference.

“In inflationary times, every dollar matters right now when you’re going to the grocery store and you’re spending more than you’ve ever spent before,” Huston said.

Join the conversation and sign up for the Indiana Two-Way. Text “Indiana” to 73224. Your comments and questions in response to our weekly text help us find the answers you need on statewide issues.

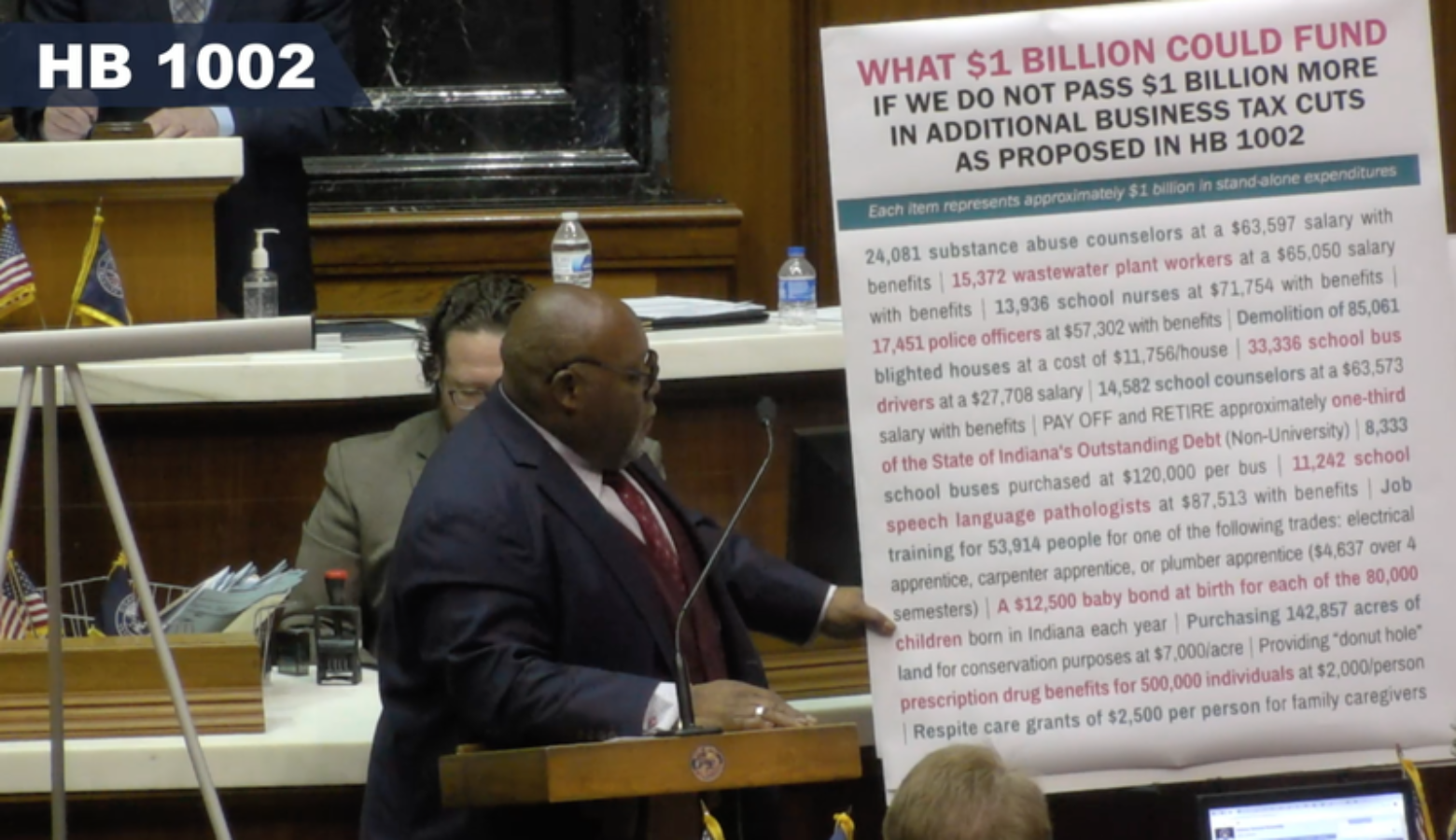

Democrats like Rep. Ed DeLaney (D-Indianapolis) said the state should invest the $1 billion on things like child care, student debt and job training.

“Who’s the symbol of Indiana? Is it Scrooge McDuck?” DeLaney said. “Is that who we are?”

But Republicans like Rep. Jack Jordan (R-Bremen) said with record state revenues and budget surpluses, a tax cut is the responsible thing to do.

“People work hard,” Jordan said. “They should get their money back.”

Rep. Carey Hamilton (D-Indianapolis) called the bill “fiscally irresponsible.” She argued that, with all the federal stimulus money that poured into the state, Indiana still doesn’t know what its future revenues will look like.

Senate Republicans have been saying something similar. And because of that, the measure’s future isn’t clear as it advances to the opposite chamber. Senate GOP leaders have expressed reluctance to make significant revenue decisions this year, wanting to wait until next year’s budget session.

Contact reporter Brandon at bsmith@ipbs.org or follow him on Twitter at @brandonjsmith5.