Hoosier Farmers Hit Twice With Trump Tariffs

Many economists predicted President Donald Trump’s trade war would harm U.S. farmers. Now some Hoosier farmers say they are being hurt – and twice – by tariffs on both soybeans and steel. Indiana Public Broadcasting’s Samantha Horton reports.

Fifth generation Elkhart County farmer Mike Morehouse comes from a family that’s been working the land for more than 150 years. Growing corn and soybeans, he recently bought a new grain bin to store his corn.

“Well the grain bin’s 48-foot diameter and it’s 15 rings high. It holds 72,000 bushels of grain, which is 70 semi-loads,” says Morehouse walking up the structure. “It will be used this fall for holding our corn harvest that’s coming up.”

The bin went up last month, but Morehouse made the purchase at the end of last year.

“We talked to the people who we bought our grain bin from and they said that the grain bin has went up $21,000 in purchase price if we wouldn’t had bought this thing back in December,” he says.

Hochstetler Grain Equipment sales representative Kevin Herschberger has been selling farm equipment, including grain bins, for the past 28 years.

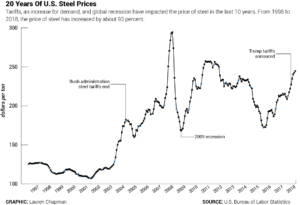

He says several factors affected the price difference Morehouse stated, including year-end discounts and last year’s lower cost for steel. But he says President Trump’s tariffs have caused prices to rise.

“Pretty much across the line there has been a price increase. Several different manufacturers have taken larger increases to the tune of 14-15 percent,” says Herschberger. “Others are smaller. I think the smallest I know is 3.5 percent, so anywhere in between there.”

Morehouse says if he’d had to pay the increased price, he’d have found other ways to store his excess corn instead.

Morehouse says if he’d had to pay the increased price, he’d have found other ways to store his excess corn instead.

“We probably wouldn’t have purchased it for a $21,000 increase. We would have figured out another way to harvest our grain putting it in other places,” he says.

While the grain bins and other equipment are made of American steel, Purdue University agricultural economics professor Wally Tyner says when prices went up for foreign steel, it gave domestic manufacturers an excuse to raise their prices, too.

“Let’s suppose that you are a steel or aluminum producer and your price is 100 and your competitors price is 100. Then your competitor gets a 25 percent tariff, so their price is now 125,” says Tyner. “Are you going to leave your price at 100? No, your gonna increase you price close to, maybe a little below, what your competitors is.”

Herschberger says that artificial jump in prices has impacted his company’s sales.

“We have noticed people not being quite as quick to make a purchase decision, thinking about it longer,” he says.

Tyner says the rise in farm equipment prices and the decline in crop sale prices is a double whammy for farmers’ bottom lines.

“They use tractors and combines and balers, all of that’s steel and some aluminum. Farmers store their crops in farm bins; steel and aluminum,” he says. “And so the cost of those inputs goes up and of course the cost of their outputs is going down; soybean tariffs and the corn tariffs and the like. So they’re really getting squeezed. Farm incomes were already low and now they’re getting squeezed at both ends – the output prices going down and the input prices going up.”

Morehouse says he supports the president’s trade disputes, but is prepared for a possible lose in money this year.

“We hope and pray that the president’s doing the right thing,” he says. “I have confidence in him that he will try to get this figured out soon and hopefully by Christmastime this year we can be back into able to sell this crop at a profitable level.”

But many ag producers are less optimistic. A recent Purdue survey of 400 farmers across the country saw the largest decline in confidence in the index’s history, correlating to the timeframe in which the tariffs were enacted.

And this impact will not just hurt farmers, but the farm equipment retailers also.

“With time, if things don’t correct, this will certainly hurt our bottom dollar,” says Herschberger.