No State Income Tax Relief For Unemployed Hoosiers In Bill Headed To Holcomb

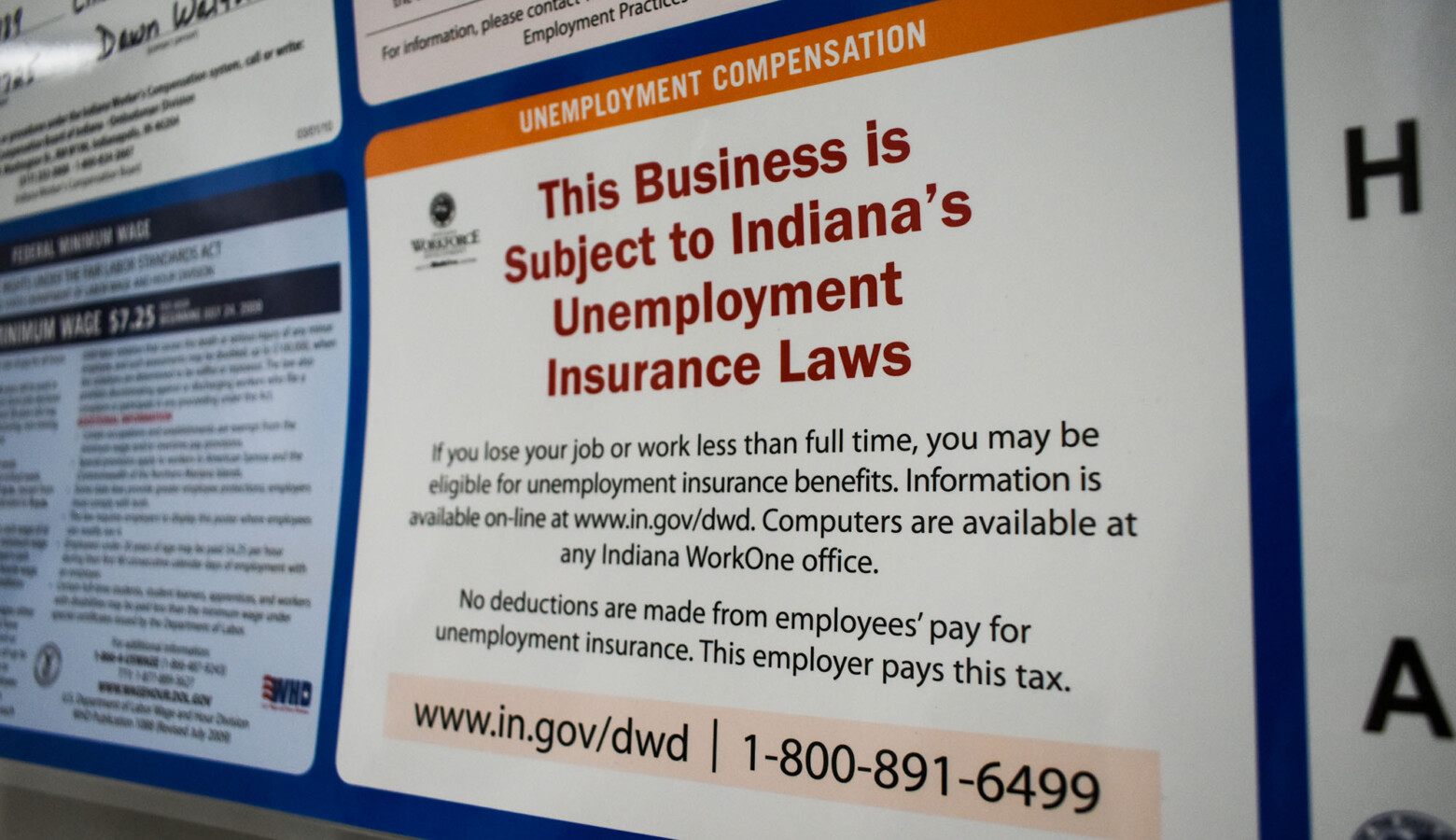

Indiana will tax unemployment benefits received in 2020 as income in legislation headed to the governor. It comes after lawmakers debated a bill that would have temporarily waived the taxes in order to match a one-time federal tax break.

Lawmakers in the House wanted to shield $10,200 of unemployment benefits from state income tax, mirroring federal tax relief provided to out-of-work Hoosiers. But the Senate disagreed and removed that language in the now-final version of the SB 383.

Rep. Dan Leonard (R-Huntington) argued it’s only fair to tax unemployment insurance when some Hoosiers received more than they would working at a job paying $20 an hour.

“We’ve charged income tax on state benefits for years,” Leonard said. “Why would we do anything else with the money that’s coming from the federal government to boost that income up even higher?”

But Democrats like Rep. Ed Delaney (D-Indianapolis) bristled at the change to the bill. He accused some Republican lawmakers of resenting people who received benefits in the pandemic.

“People were asked to stay home [and] change their lives and some of them got a few dollars more than they used to get. Isn’t that just terrible?” Delaney said, sarcastically.

Join the conversation and sign up for the Indiana Two-Way. Text “Indiana” to 73224. Your comments and questions in response to our weekly text help us find the answers you need on COVID-19 and other statewide issues.

In debate on the House floor, lawmakers frequently pointed out that the state is set to spend another $500 million of federal relief money towards refilling the unemployment fund.

Indiana currently has no outstanding loan to the federal government to cover unemployment benefits, after paying off a previous loan with $400 million from the CARES Act. The additional money would put the trust fund back near pre-pandemic levels, although it still wouldn’t be deemed financially solvent by Department of Labor standards.

Some framed it as an attempt to keep taxes for businesses low while being indifferent about taxes for individuals. A negative balance in the fund typically forces tax rates for employers to rise in order to pay off federal debt that cover benefits, however those rules were suspended by the federal government during the pandemic.

Contact reporter Justin at jhicks@wvpe.org or follow him on Twitter at @Hicks_JustinM.