Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

The Indiana Department of Revenue issued guidance Tuesday on how Hoosiers who got unemployment benefits last year should file taxes after weeks of the department asking people to wait due to potential legislative changes.

Hoosiers who received unemployment benefits cannot claim the $10,200 federal tax break on their state taxes. That applies even if the unemployment benefits came from one of the new federal programs started in the pandemic. It comes after the legislature passed a law linking Indiana’s tax code to some pre-pandemic language.

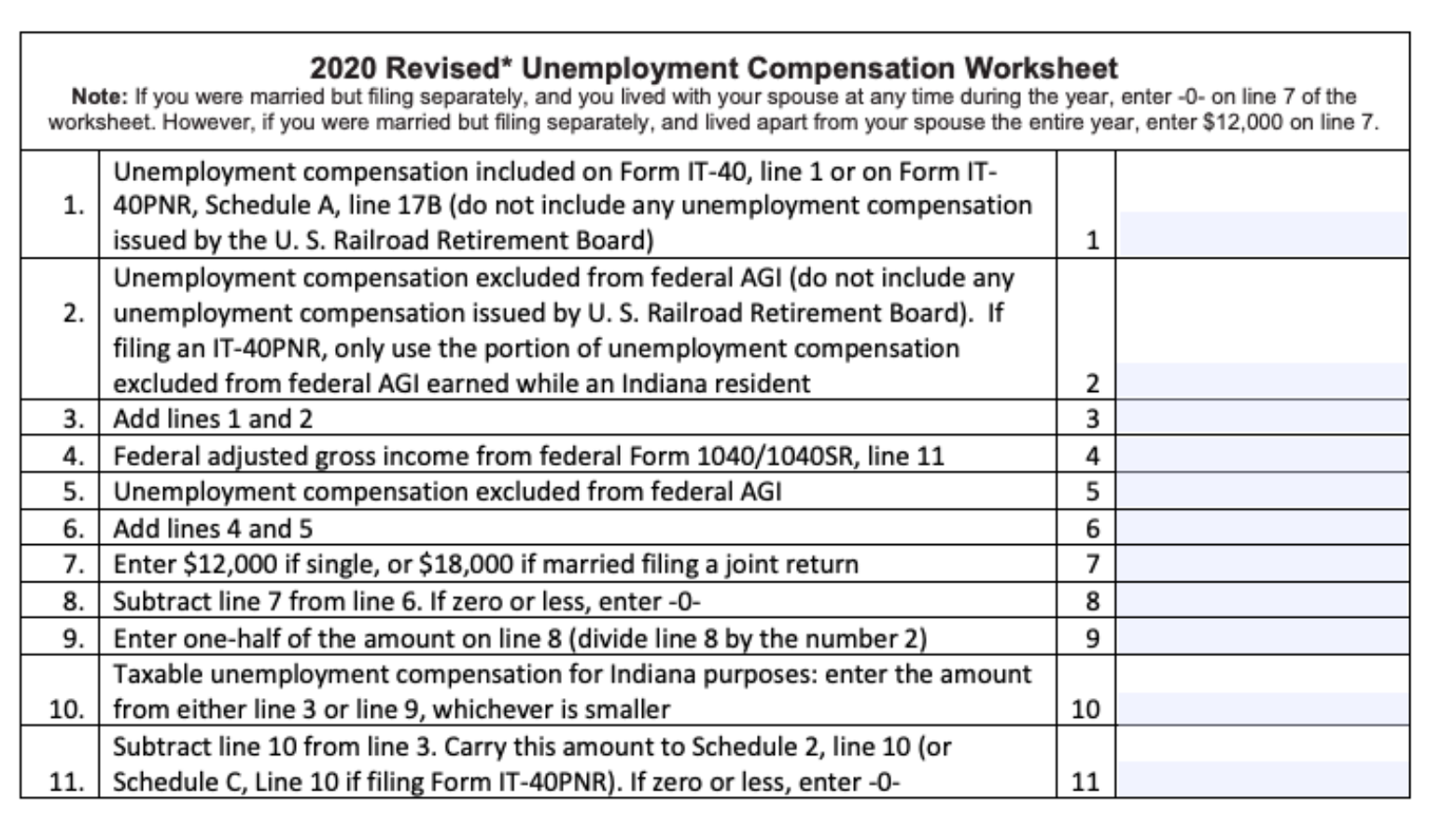

However, there may still be other tax deductions for out-of-work Hoosiers. The state recently issued an updated worksheet on their website to help people determine exactly what that is. For those using software to help them with state taxes, DOR is advising to make sure you’re using the most updated version or to check for instructions that add back unemployment income excluded from their federal adjusted gross income

All Hoosiers still need to pay their taxes by May 17 this year to avoid late fees. DOR says if people with benefits have already filed, there’s no need to amend their tax return at this time, but additional guidance will come soon.

Contact reporter Justin at jhicks@wvpe.org or follow him on Twitter at @Hicks_JustinM.