Indiana tax review task force issues broad recommendations focused on property tax changes

Help is likely on the way for property tax payers, but that help will also take time. That’s the message from a state task force that spent the last two years reviewing Indiana’s tax system.

The task force issued recommendations Wednesday that broadly point towards improving transparency and simplicity in property taxes; providing relief, particularly for those age 65 and older; and reducing personal property taxes for businesses, a tax they pay on equipment.

Task Force Chair Rep. Jeff Thompson (R-Lizton) said any property tax changes won’t affect next year’s bills.

“People understand that, in the ’25 session, you can’t affect the ’25 bills. It’ll be ’26,” Thompson said. “That’s been the standard, and so I don’t see most people not understanding that.”

Rep. Ed DeLaney (D-Indianapolis) was the only task force member to vote against the recommendations. He said lawmakers need to take bolder action to address a tax shift over the last decade that’s hurt homeowners.

“So, I think it’s time to get serious about what’s happened to the tax caps,” DeLaney said. “After 13 years of one-party control and 15 or 16 years of the tax caps, I don’t think they’re working for the homeowners.”

Thompson says the task force avoided more specific recommendations because they would’ve been too detailed for the task force to agree on.

Join the conversation and sign up for the Indiana Two-Way. Text “Indiana” to 765-275-1120. Your comments and questions in response to our weekly text help us find the answers you need on statewide issues, including our project Civically, Indiana.

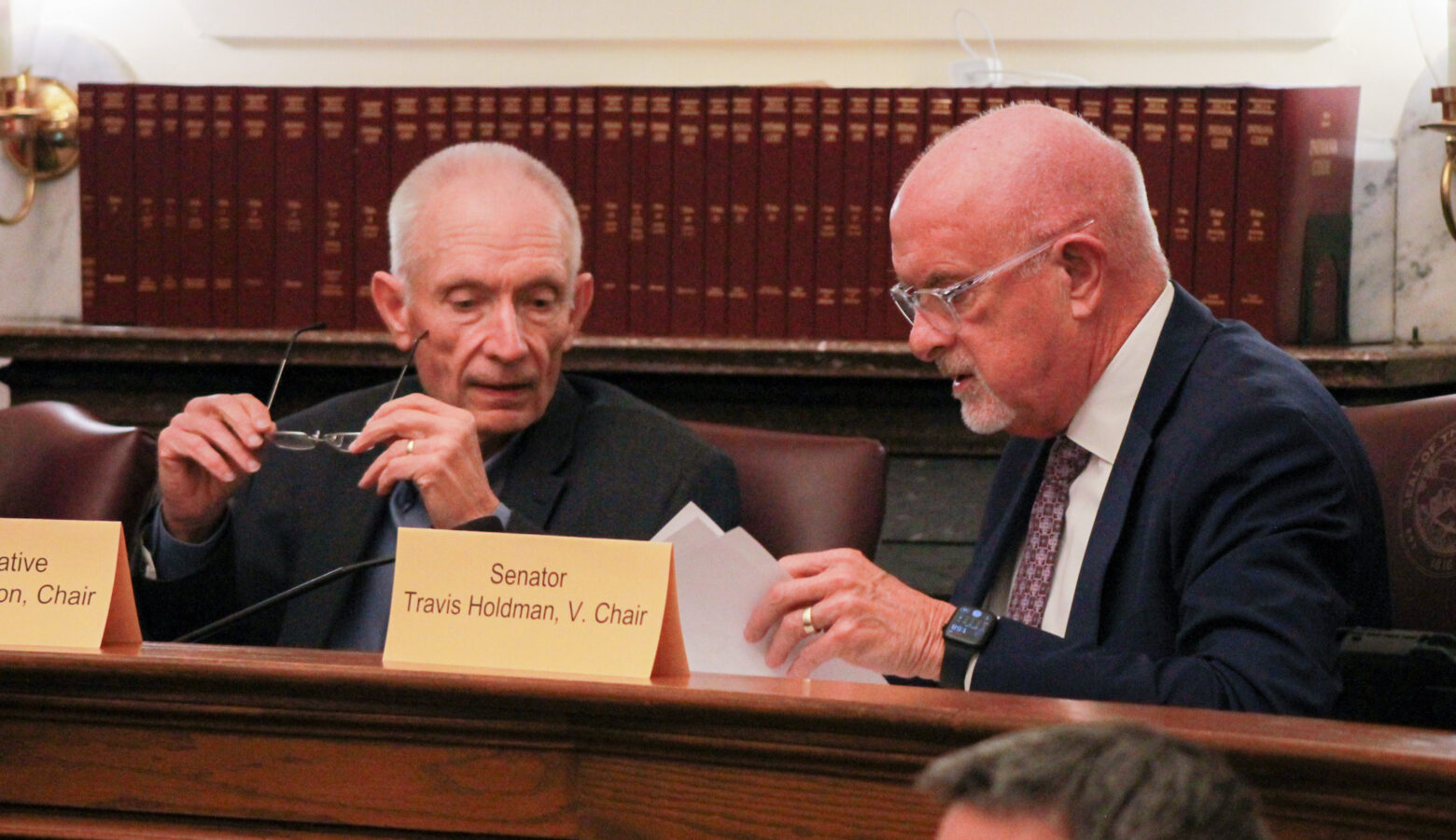

Task Force Vice Chair Sen. Travis Holdman (R-Markle) said property tax reform is going to be a multi-year process.

“There are two solutions to lowering property taxes: less spending, less borrowing and, of course, reliance on local income tax,” Holdman said.

Holdman said there is $4.8 billion across the state in potential revenue for local governments if they fully utilize local income taxes.

The task force was initially formed with an eye towards eliminating the state individual income tax. While that idea has largely been abandoned for the foreseeable future, Holdman said he’d still like to see the state cut its income tax rate whenever possible.

“If we have revenue that exceeds where we need to be spending money — at about 3.25 percent [annual growth] — I think, in those cases, we need to give it back through tax cuts to the individual taxpayers,” Holdman said.

There are more individual income tax rate cuts already scheduled in the next few years.

Brandon is our Statehouse bureau chief. Contact him at bsmith@ipbs.org or follow him on Twitter at @brandonjsmith5.