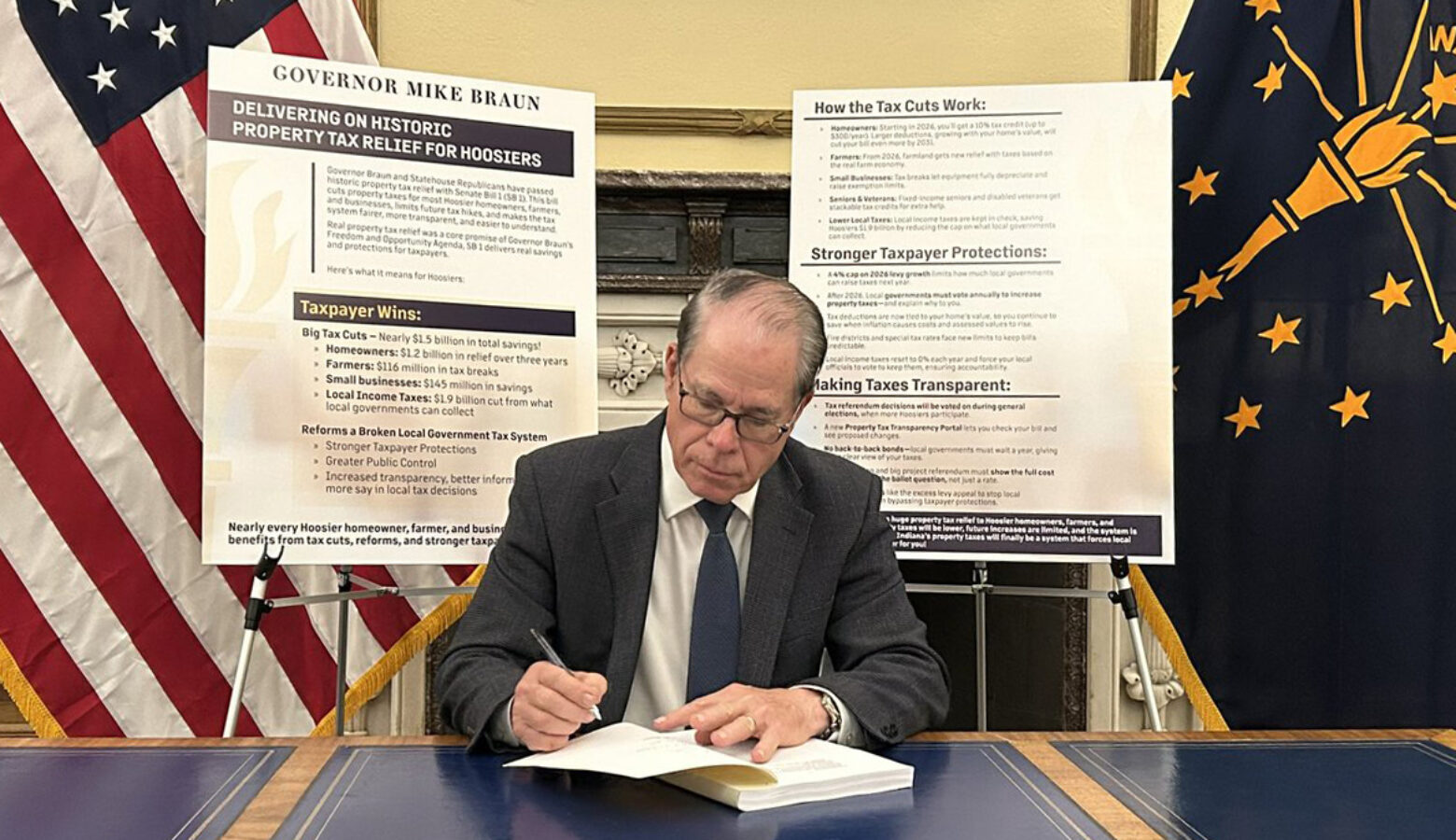

Gov. Mike Braun signs ‘historic’ property tax relief bill into law, critics call it a ‘lose-lose’

Indiana’s major property tax reform package is now law, as Gov. Mike Braun signed the measure Tuesday.

In a statement on social media, Braun called the legislation “historic tax relief” that benefits nearly every Hoosier.

Beginning next year, Senate Enrolled Act 1 creates a new property tax credit of 10 percent of a homeowner’s bill, up to $300. It adds additional credits for older Hoosiers and veterans. It eventually exempts most businesses from the business personal property tax, a tax on equipment. And it slightly changes how farmland is assessed, to help bring down farmers’ property taxes.

READ MORE: Senate gives final approval to major property tax reform bill, sends it to governor

Join the conversation and sign up for our weekly text group: the Indiana Two-Way. Your comments and questions help us find the answers you need on statewide issues, including our project Civically, Indiana and our 2025 bill tracker.

But in a statement, Rep. Greg Porter (D-Indianapolis) said all that will cost local governments and schools up to $1.8 billion in funding over just the next three years.

To help balance that, the measure gives locals new income tax tools. And that prompted Porter to call the bill a “lose-lose” that tries to shift the blame for taxes to local communities.

Brandon is our Statehouse bureau chief. Contact him at [email protected] or follow him on Twitter at @brandonjsmith5.